? (+86)-0755-89205789 Ø ? sales@stusupplychain.com NVOCC:MOC-NV09192 | FMC:030310

- Article title

- Article summary

- Article content

- Multi Field Search

NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-03-26 Origin: Site

The U.S. customs landscape for cross-border e-commerce is undergoing seismic shifts, with stricter enforcement on undervalued goods and potential termination of the $800 de minimis exemption by September 2025. Here¡¯s what sellers and logistics providers must know to navigate this high-stakes environment.

$800 Exemption Countdown:

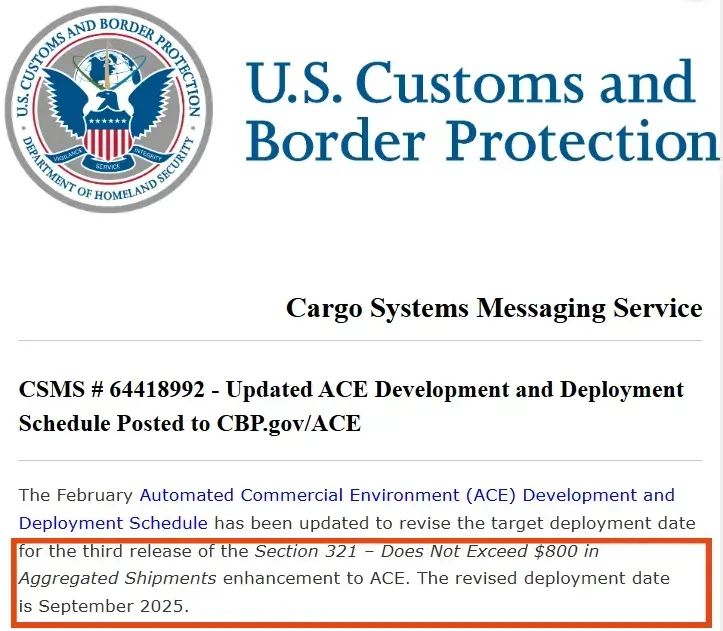

U.S. Customs confirmed plans to complete system upgrades by September 2025 to tax sub-$800 shipments.

Current exemption remains in place but is under "microscope-level scrutiny"¡ª70% of Chinese e-commerce shipments now face inspections (up from 5%).

ACE System Upgrades:

New "Estimated Arrival Time" field added to filings, requiring tighter logistics-coordination.

Red Alert Threshold: ACE will flag imports exceeding $800/day per importer, triggering audits.

Penalties & Delays:

Inspection times stretched from 3 to 21 days.

Amazon stockout rates hit 47%; shipping costs surged 30¨C50%.

Example: A Ningbo home goods seller was fined $280,000 (1/3 of annual profit) for a 12% undervaluation.

Logistics Chaos:

Revenue Protection: The U.S. collected $3.2 billion via de minimis in 2023; closing this loophole could generate billions more.

Anti-Dumping: Targeted at Chinese sellers exploiting low-value thresholds to avoid tariffs.

Compliance Over Speed:

Accurate Declarations: Match invoices to HS codes and declared values (discrepancies >5% risk penalties).

Documentation: Keep procurement records, factory contracts, and payment proofs for 5+ years.

Diversify Clearance Channels:

Use T01/T11 for commercial shipments if T86 (de minimis) is canceled.

Avoid "shortcuts" like transshipment hubs¡ªflagged as high-risk by CBP.

Cost Control:

Buffer +30% for shipping/logistics due to delays.

Shift air freight to Miami/Los Angeles ports with faster processing.

Tech-Driven Solutions:

Adopt AI valuation tools (e.g., Customsly) to auto-calculate duties.

Integrate ACE-compatible EDI systems for real-time status updates.

Optimists: Hope the $800 exemption extends to September, buying time.

Realists: Prepare for cancellation¡ª"The golden age of tax-free small parcels is over," warns a Shenzhen 3C seller.