? (+86)-0755-89205789 Ø ? sales@stusupplychain.com NVOCC:MOC-NV09192 | FMC:030310

- Article title

- Article summary

- Article content

- Multi Field Search

NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-10-10 Origin: Site

Due to the turbulent tariffs and the weakening demand in the United States affecting the global supply chain, liner companies are canceling voyages at an unprecedented rate since the peak of the pandemic.

At present, the operating profit margins of carriers on several major routes have fallen below the break-even point, but shipping companies still prioritize market share over profitability and give precedence to ensuring market share.

According to a new analysis by the supply chain digital service company Project44, in October 2025, the number of suspensions between China and the United States is expected to reach an unprecedented level, with 67 planned suspensions from China to the United States and 71 from the United States to China. The analysis points out that the level of capacity reduction exceeds the record during the COVID-19 pandemic, highlighting the serious disruption caused by the recent tariff measures implemented by the Trump administration to the maritime trade.

Bart De Muynck, the chief strategy officer of Better Supply Chains, said, "The intensity of carriers' canceling flights has not been seen since the early days of the pandemic. This strategy is more to maintain the stability of freight rates in a market distorted by tariffs rather than to respond to a crisis."

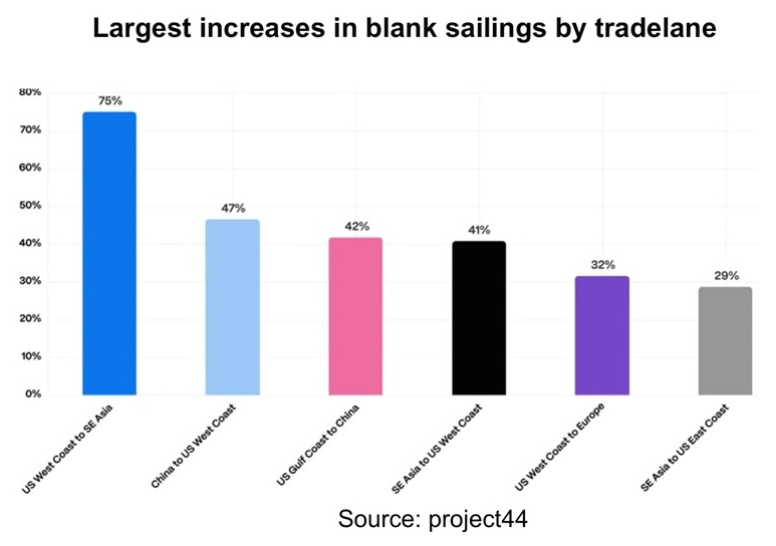

The most affected trade routes include the route from the US West Coast to Southeast Asia, where the number of suspensions has increased significantly by 75% year-on-year; while the number of suspensions on the routes from China to the US West Coast and from Southeast Asia to the US West Coast has increased by 46.5% and 40.7% respectively.

These data highlight how liner companies are responding to weak demand and adapting to the uncertain situation.

Since Donald Trump took office, Sino-US trade has undergone tremendous changes. US imports from China have declined for five consecutive months, and exports have declined for nine consecutive months. Since the beginning of the year, imports have decreased by 27% year-on-year, and exports have plummeted by 42%.

In the face of this situation, carriers are using the only means they still control - capacity - to meet the challenges. The fluctuations caused by tariffs have led to a reduction in sailing schedules and a decline in demand, and suspension has become the preferred way to support freight rates. Although the scale of this adjustment is huge, the procurement model has remained surprisingly stable. Most carriers have not withdrawn production from China in a substantial way, but have adjusted the shipping time to deal with the soaring tariffs.

The consulting company Linerlytica pointed out this week that shipping companies are facing huge challenges in the latest round of efforts to restore freight rates.

The consulting company reported, "Affected by the Chinese Golden Week holiday, market activities have slowed down, and freight rates in the Far East are still under pressure. Although shipping companies are promoting a freight rate increase on October 15 to reverse the recent sharp decline in freight rates, the resumption of most regular routes after the suspension of Golden Week flights has hardly supported the freight rate increase."

Jefferies, an investment bank, also recently warned that due to the fact that freight rates have fallen below the break-even point of leading cost operators for the first time since the end of 2023, the weak spot freight rates will pose a threat to the contract negotiations in 2026.