? (+86)-0755-89205789 Ø ? sales@stusupplychain.com NVOCC:MOC-NV09192 | FMC:030310

- Article title

- Article summary

- Article content

- Multi Field Search

NEWS & BLOG

Views: 1580 Author: Site Editor Publish Time: 2022-07-18 Origin: Site

Freight forwarders have faced many challenges this year: uncertain markets, weak cargo volumes, increased risks and additional costs from continued congestion at destination ports, and profit returns to normal. The profiteering ends, and the involution begins.

The development of the US line market after the year is very unfavorable for the freight forwarding business. Last year's hard-to-find situation is a thing of the past. The cargo owner does not sign the contract with the owner himself, or it is easy to get the space from the market. In the case of the overall decline in cargo volume, freight forwarders began to compete to lower prices in order to compete for limited free hand cargo and complete weekly bookings. What's more, freight forwarders still sell cabins at a loss. Cargo owners are no longer satisfied with just getting a booking confirmation. After last year's baptism, cargo owners have a deep understanding of time-sensitive services, and their requirements for services have been put on the agenda again. Both fast and cheap. In a few months, the freight forwarder has been greatly reduced by the sense of demand.

In the same market, there are still a few happy and some sad. Even in the face of such a difficult market, some freight forwarders can continue to make great progress. Heroes emerge in troubled times, and the more turbulent the market is, the more it will test the coping ability of each company, and the performance of each company will therefore vary greatly.

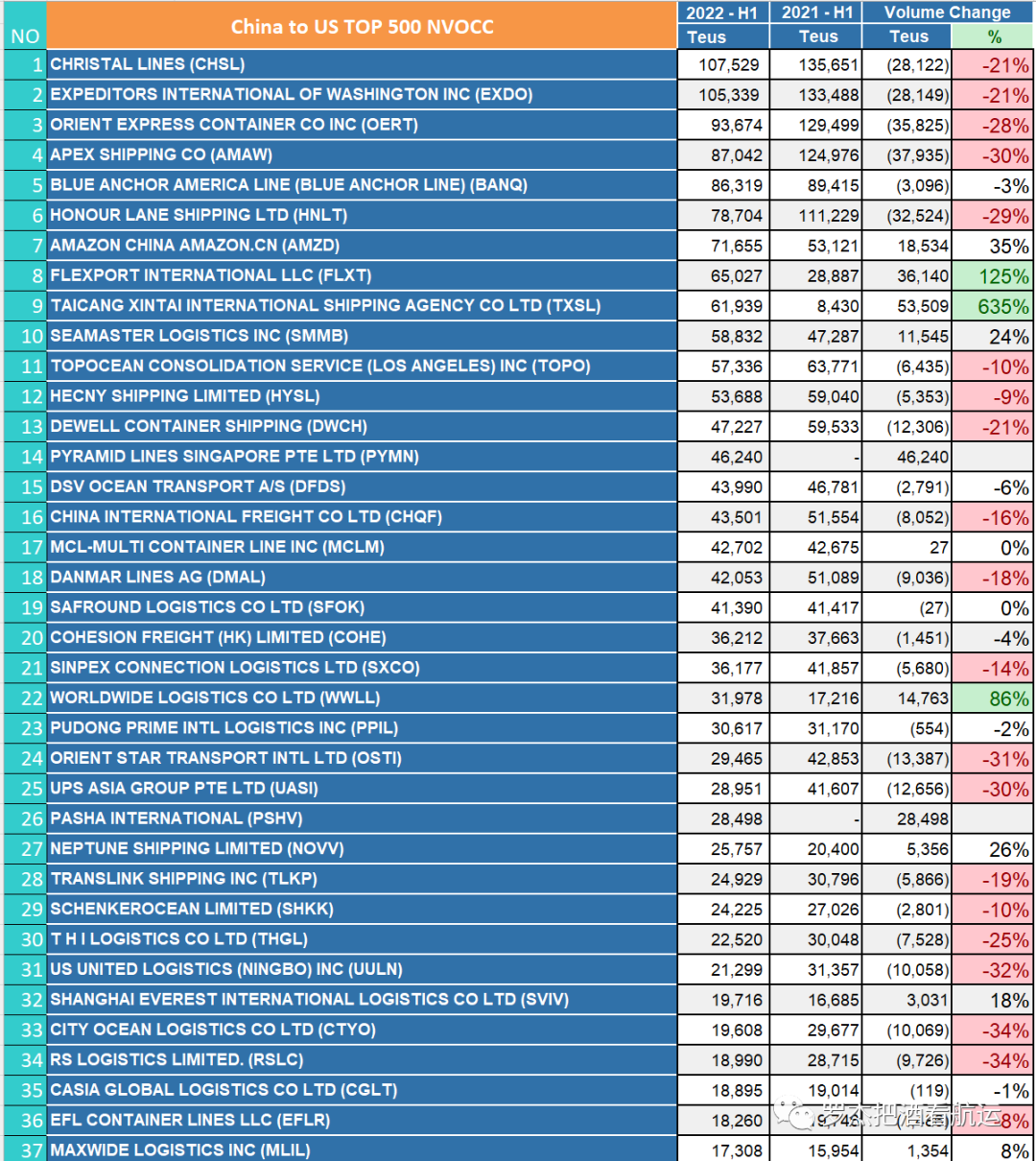

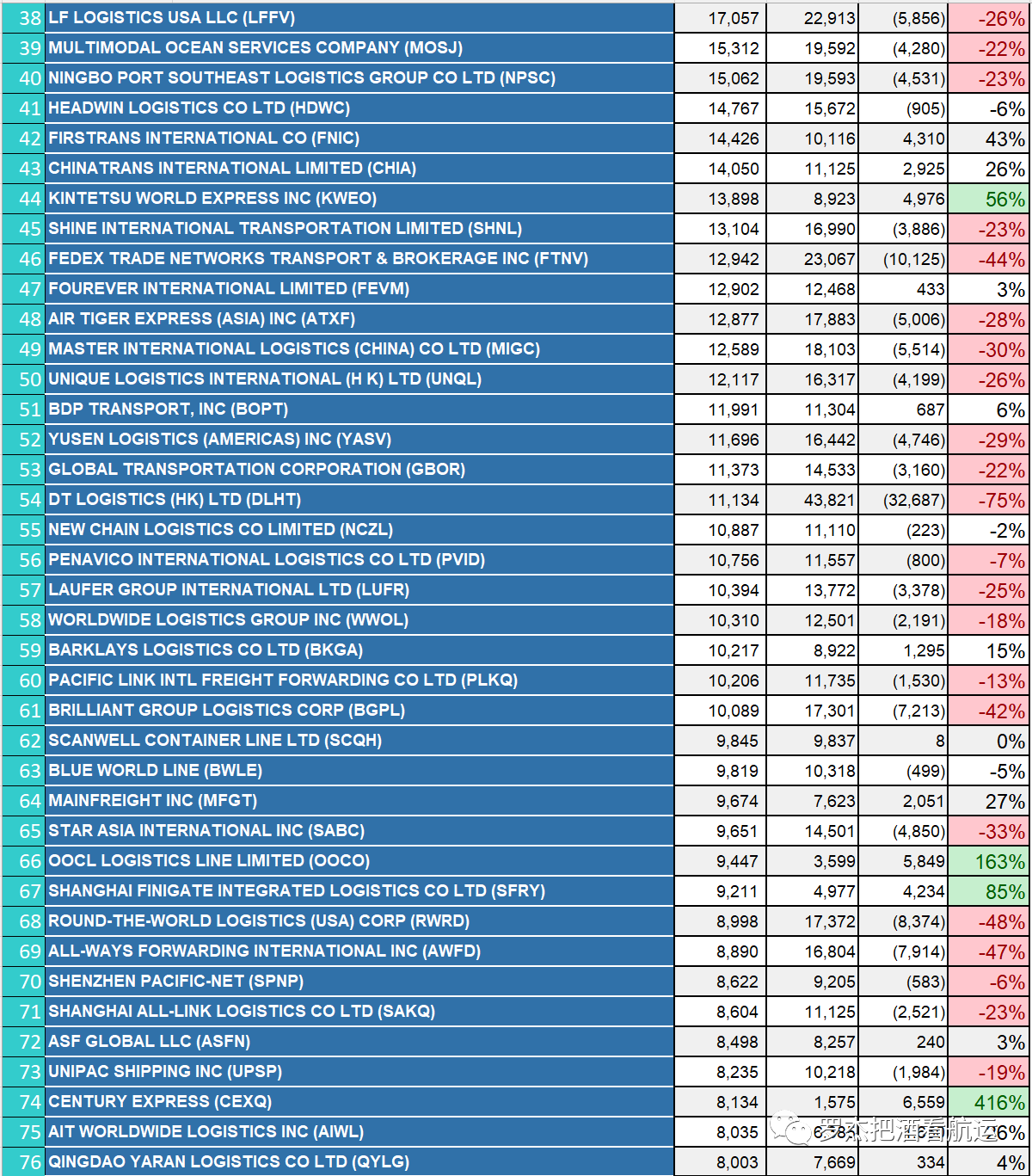

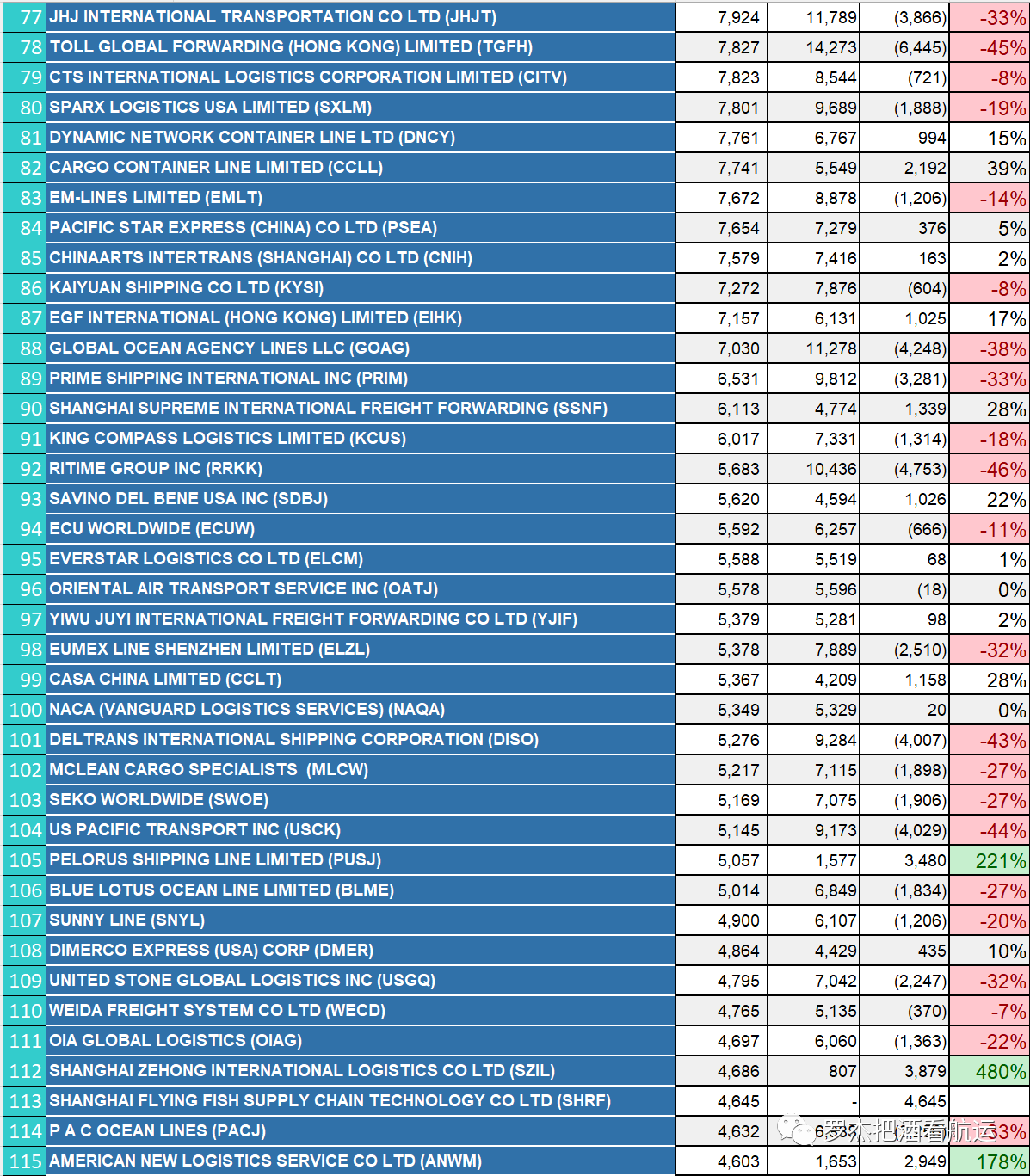

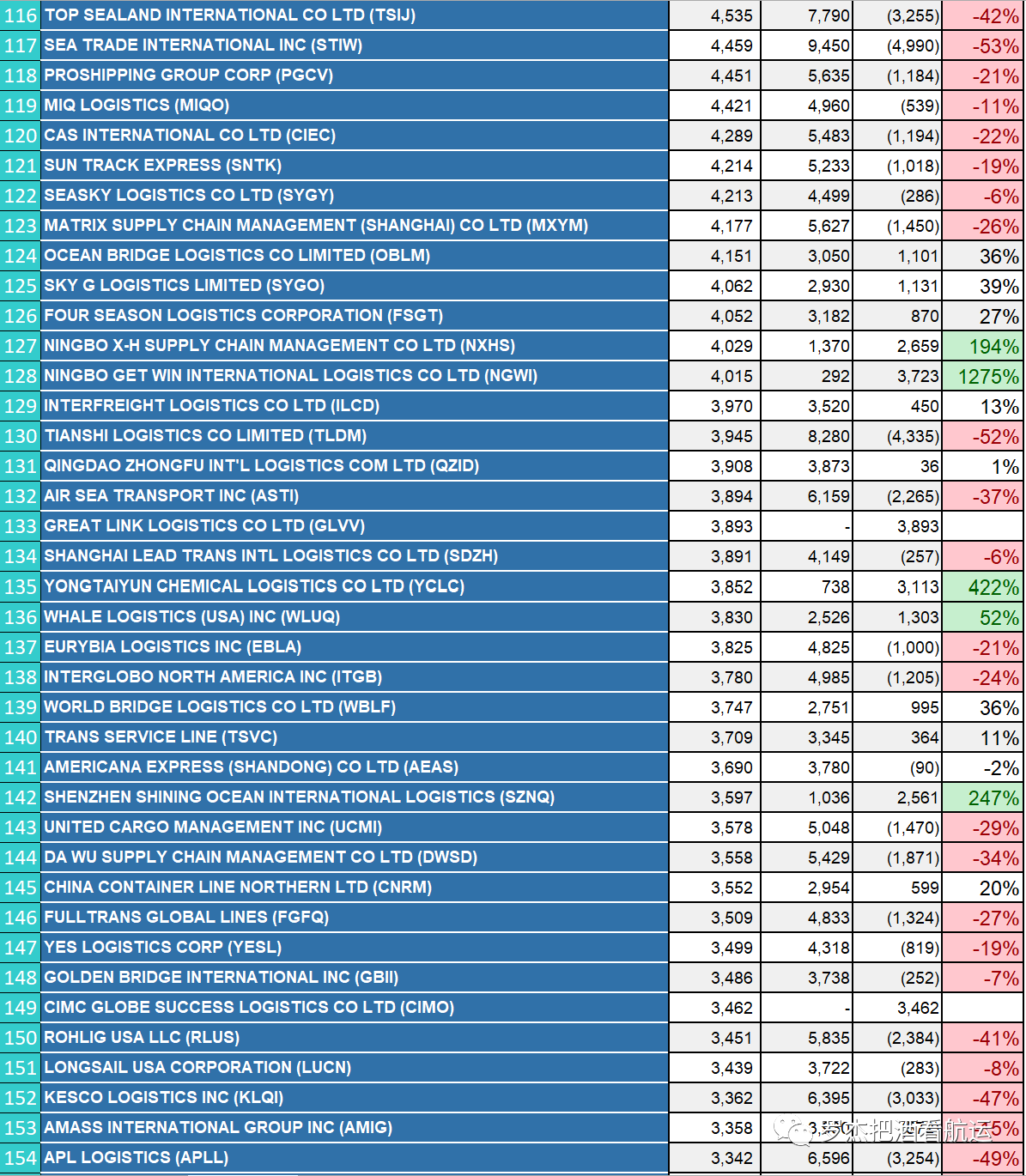

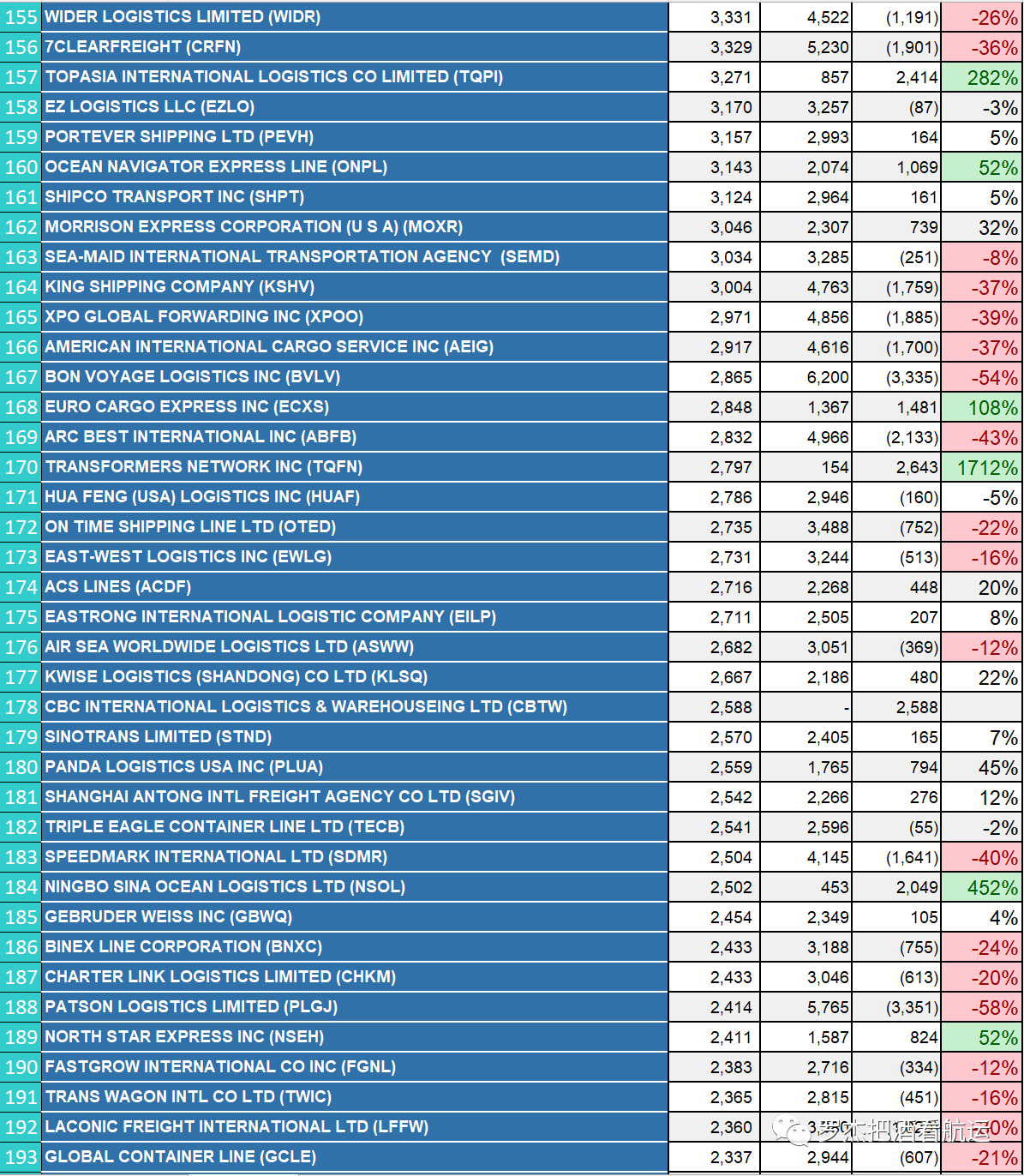

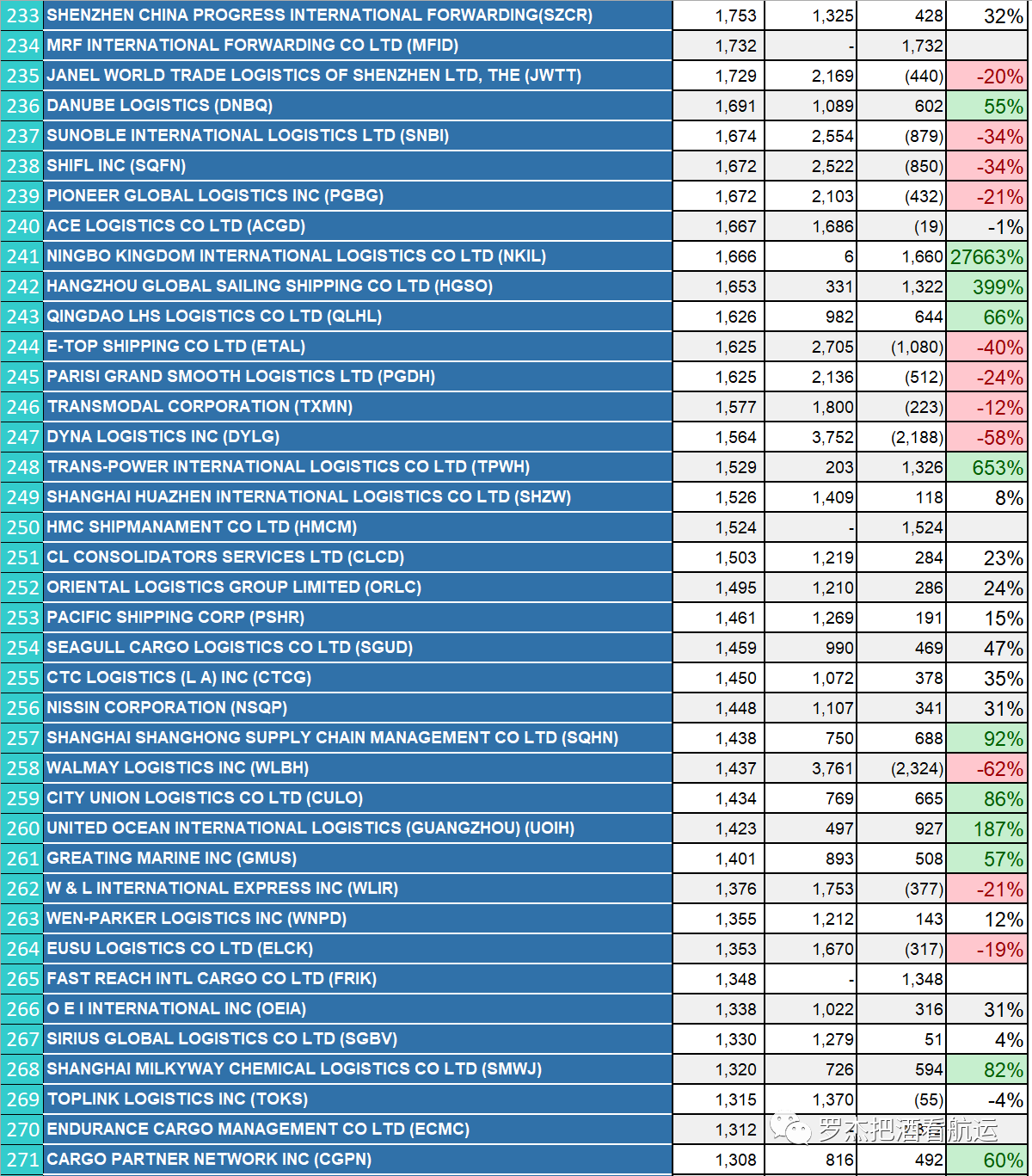

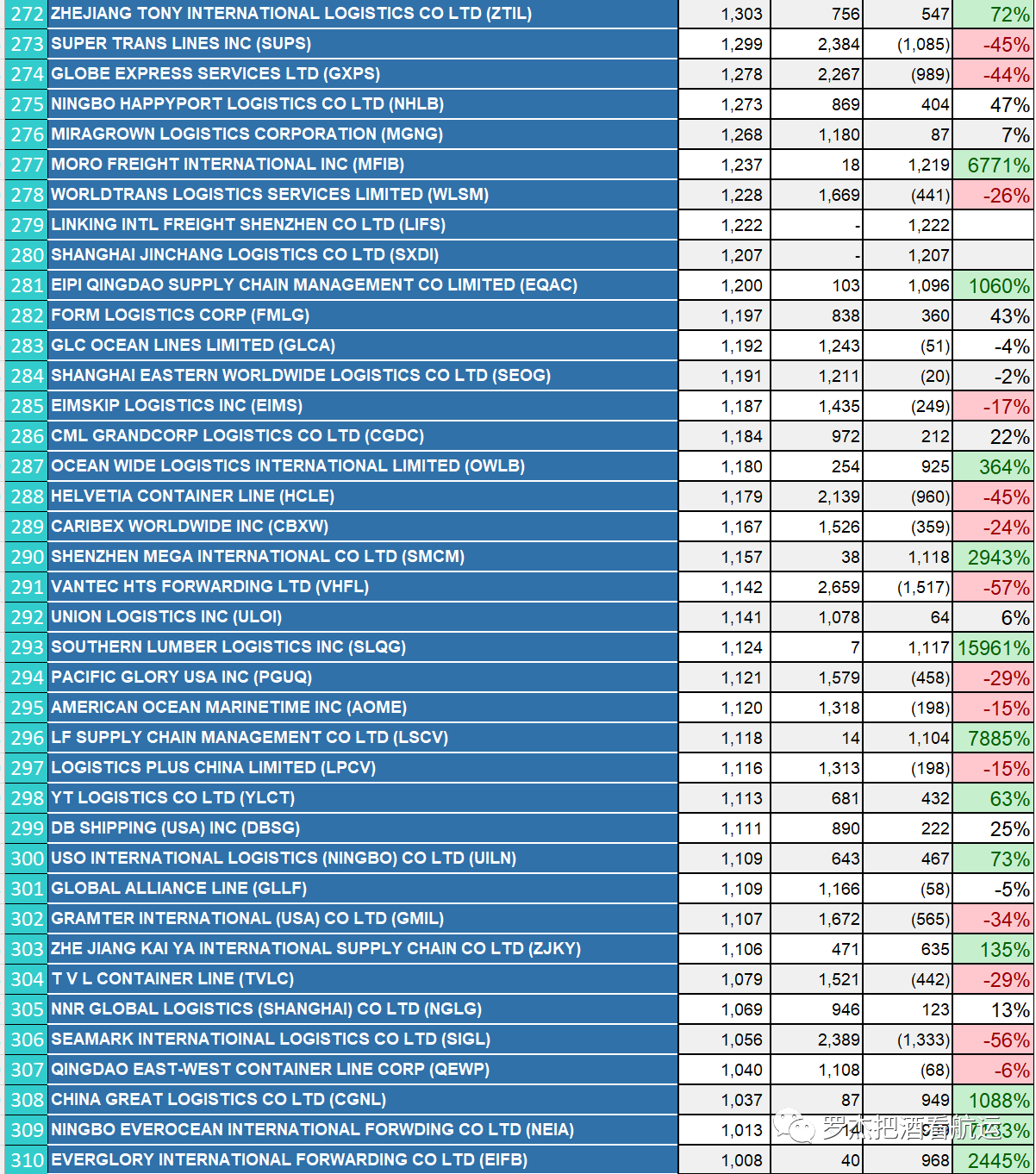

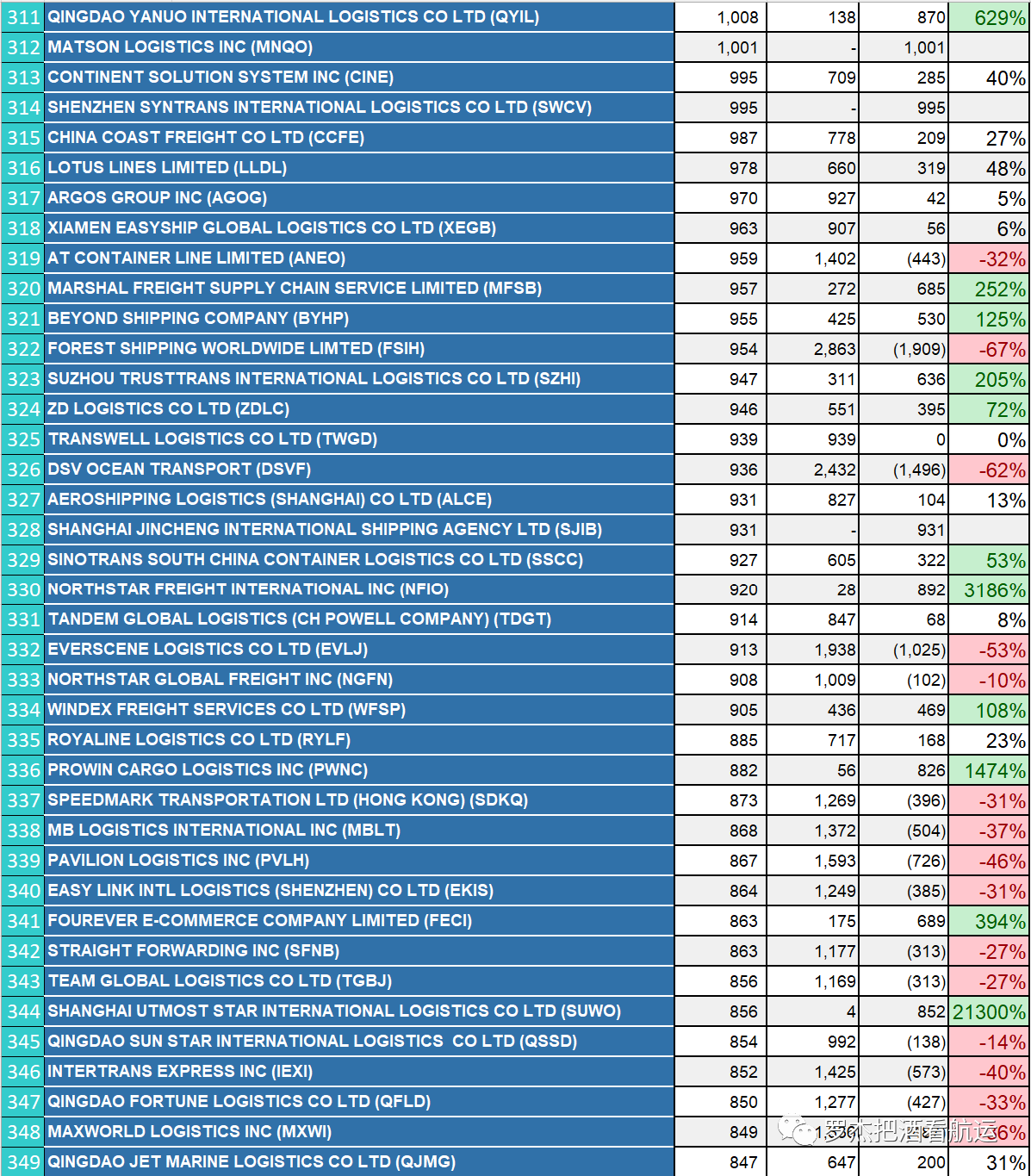

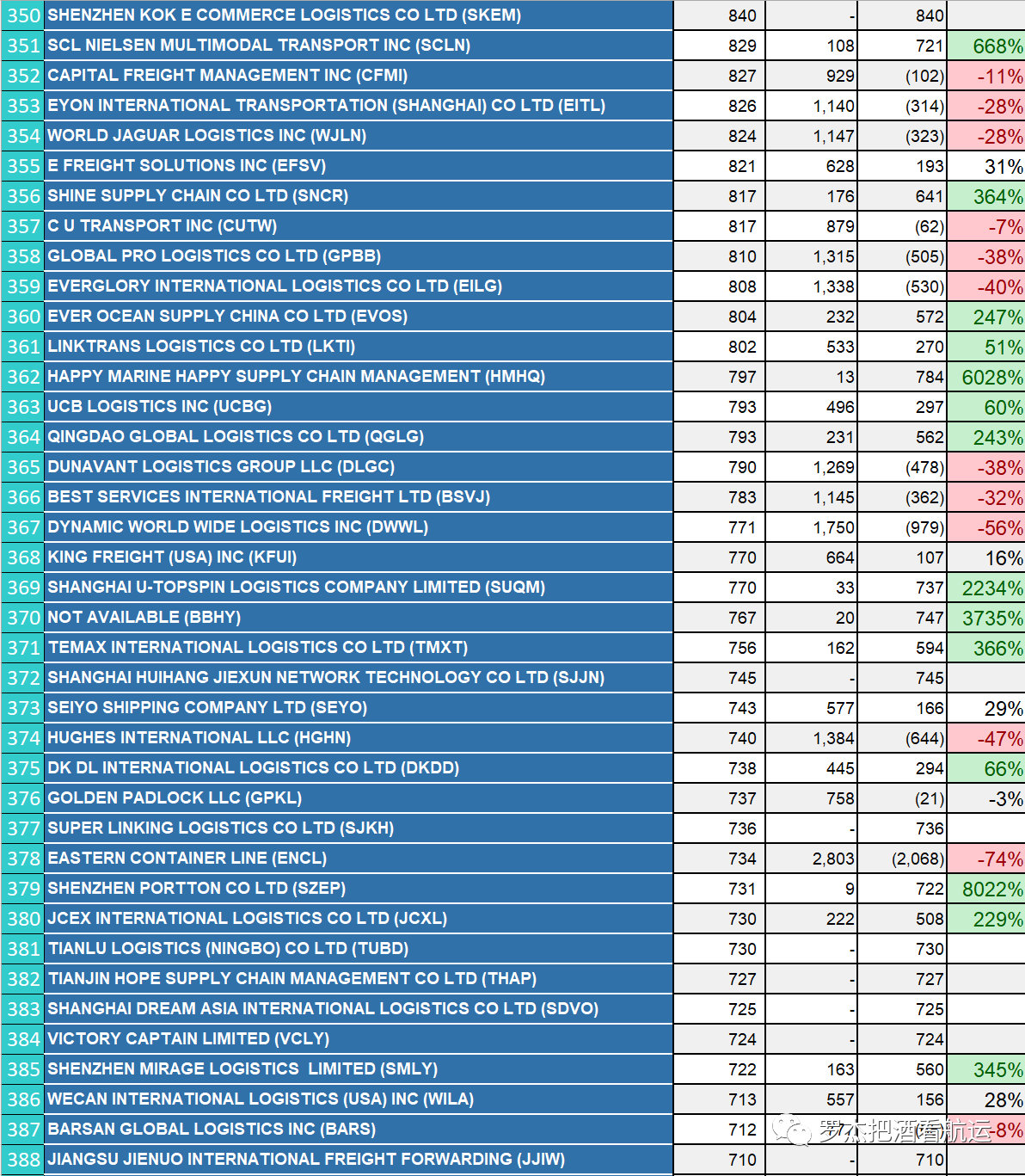

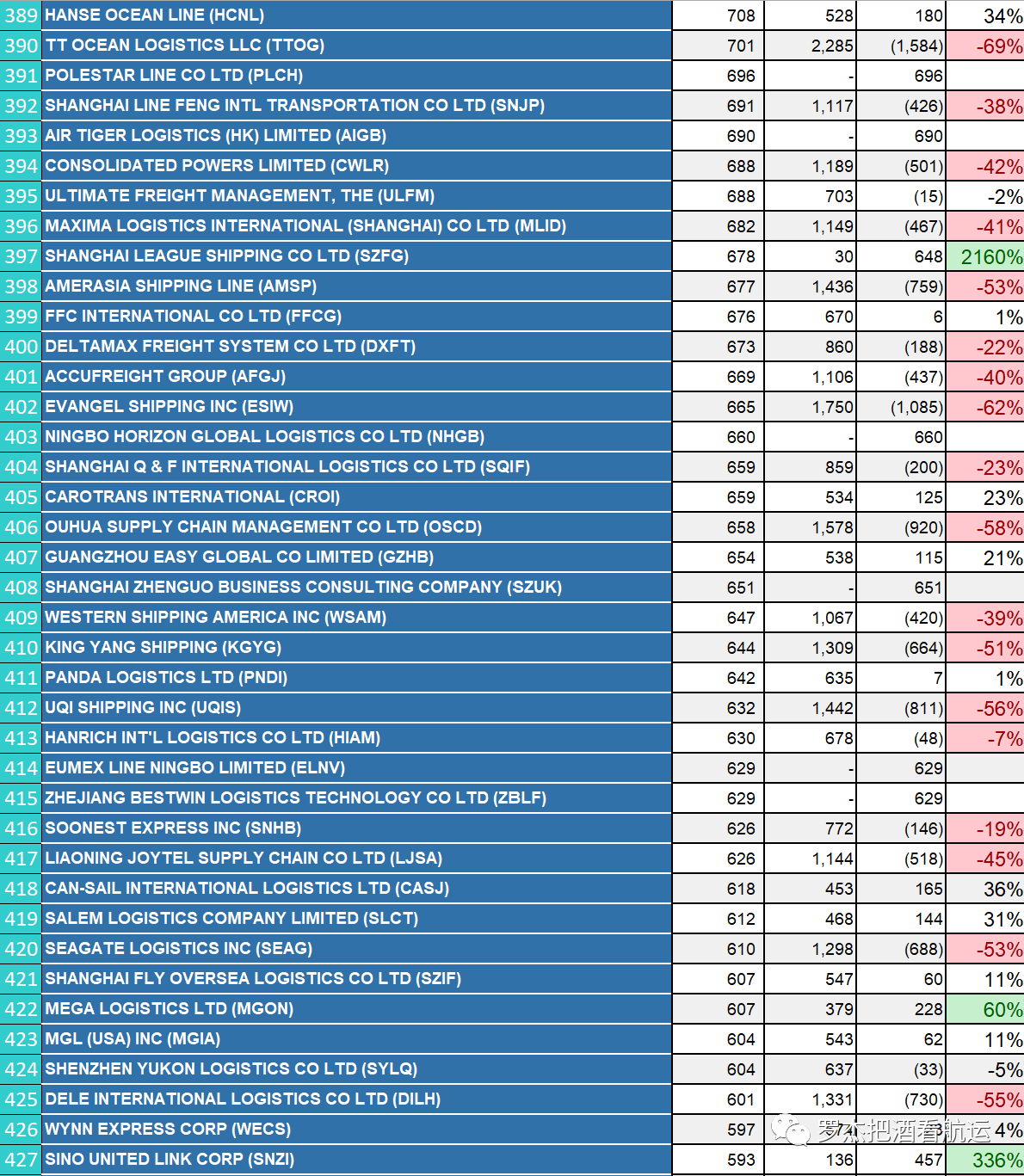

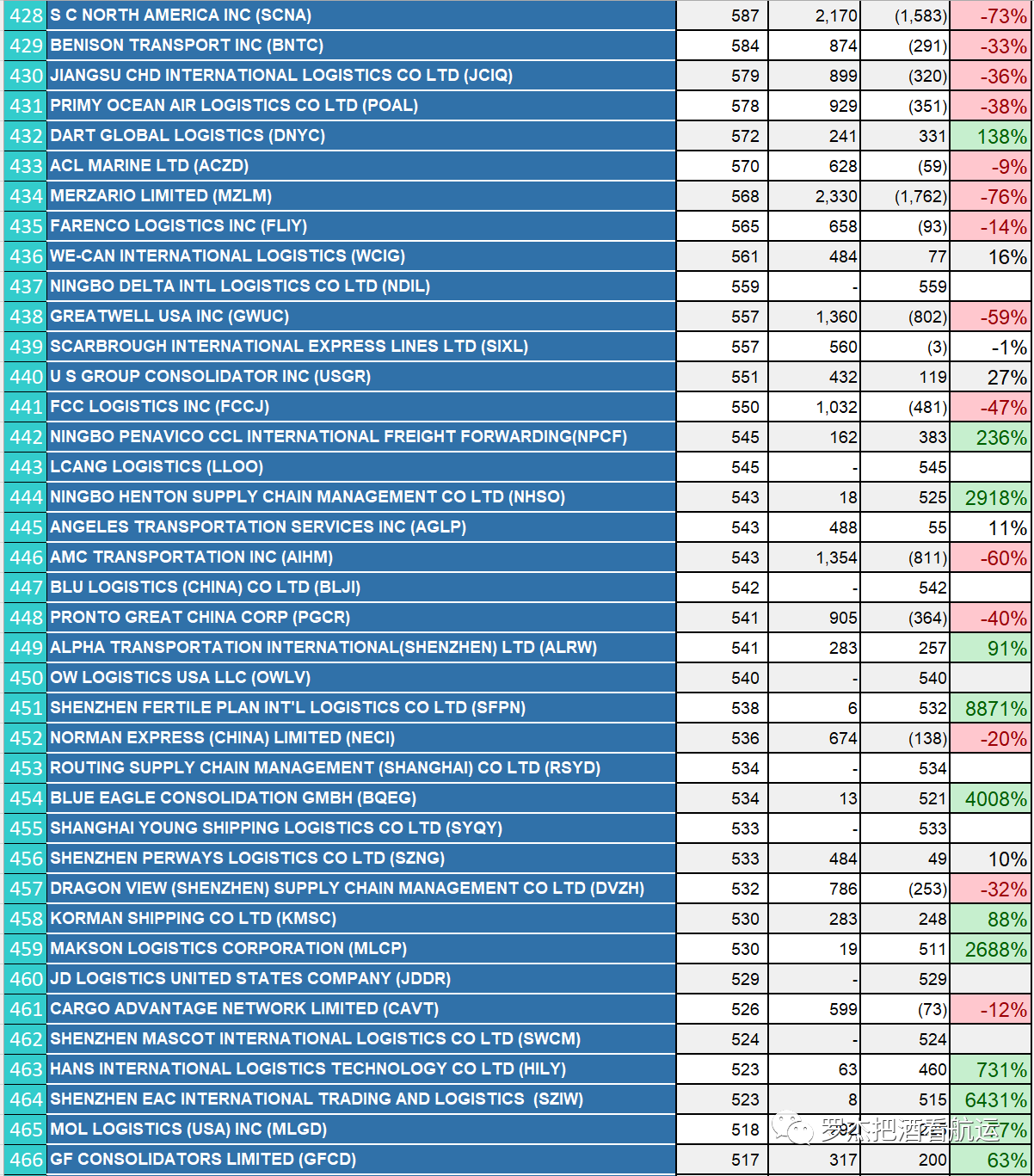

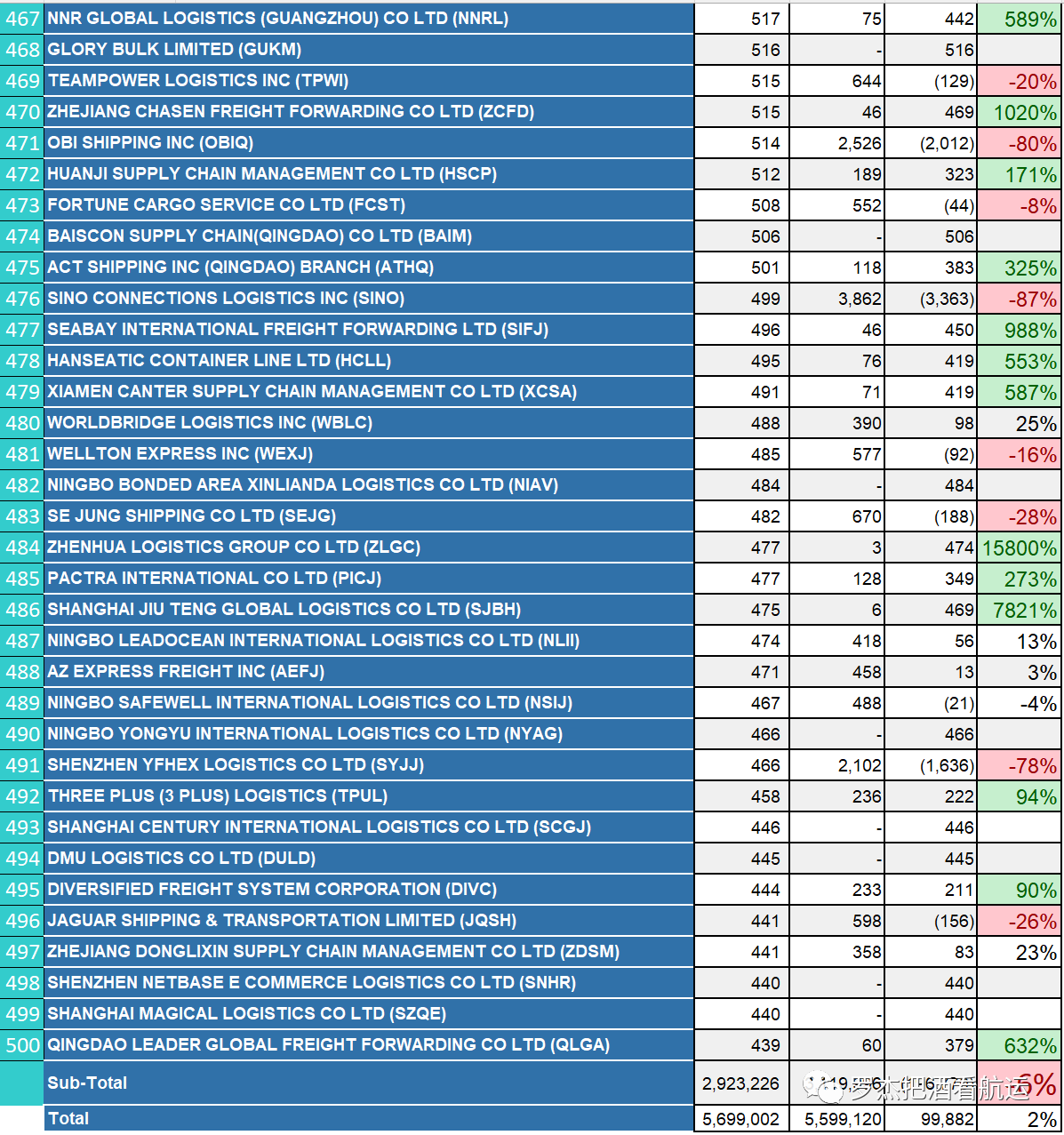

In the case of the overall market growth of 2%, the total volume of the top 500 freight forwarders fell by 6%, indicating that the volume of freight forwarding market is shrinking. % represents the change in the same futures volume, red represents a decrease of more than 6%, and green represents a year-on-year increase of more than 50%.

Among the 500 freight forwarders, almost half of the freight forwarders' freight volume remained unchanged or exceeded last year, while the other half's freight volume was less than last year. Among them, the freight volume of 216 freight forwarders (40%) fell by more than 6%, and the highest fell by 87%. At the same time, the volume of 105 freight forwarders increased by more than 50%, with a maximum increase of 27,663% (the base last year was small). Interestingly, as many as 46 brand new forwarders have appeared this year (there was no volume record last year). Brand new means that the forwarder may use a new SCAC code, or a newly established company. What everyone says is hard to do may be an opportunity in the eyes of some people.

Another notable change is that the ranking of the top 10 top forwarders has changed. Although the top 6 freight forwarders have experienced varying degrees of decline, they still occupy the top positions thanks to their solid foundation. From 7th to 10th, new names appeared. Amazon and FLEXPORT continued their growth last year and entered the top 10. The company TAICANG XINTAI was born last year and is currently ranked 9th. It is said that this is a company that helps people send AMS, not the actual controller of the volume. SEAMASTER, ranked 10, made it to the top 10 for the first time. Among the top 25 large and medium-sized freight forwarders, WWL's performance is very eye-catching. It ranked 44th in the same period last year, and this year has rapidly risen to 22nd, congratulations!

It needs to be specially explained here that the freight forwarding ranking does not 100% represent or reflect the market reality. Only forwarders who book space with their own contracts will have records. If you use someone else's contract to book the space, the cargo volume is counted under the other's contract. There is also a "mysterious" group in the market: e-commerce collection companies. These companies are the diving predators of e-commerce logistics. The focus of their work is not to sign contracts with shipowners, but to book space through agents, and do not come forward directly. Before the 2021 century market, the logistics timeliness is relatively controllable, and the shipping space is not a problem. Last year's market situation led some cargo collection companies to start paying attention to their relationship with shipowners and move to the front. If given the choice, they would still prefer to be behind the scenes.

The market in the second half of the year is full of uncertainty. If the market stalemate in the first half of the year limited the space for freight forwarders to play, and if the market is violent in the second half of the year, it will be the best opportunity for freight forwarders to regain market share. This year, only the first half has been played, and there is still a chance in the second half.

The figure below shows the comparison of China's exports to the United States in the first half of 2022 (by arrival date) and the same period last year, ranked by the volume of goods in 2022. Due to space limitations, only the top 500 forwarders are displayed.