? (+86)-0755-89205789 Ø ? sales@stusupplychain.com NVOCC:MOC-NV09192 | FMC:030310

- Article title

- Article summary

- Article content

- Multi Field Search

NEWS & BLOG

Views: 0 Author: Site Editor Publish Time: 2025-10-15 Origin: Site

The U.S. is about to impose port fees on Chinese vessels, and the global shipping industry is responding proactively.

On October 3, 2025, the U.S. Customs and Border Protection (CBP) officially issued Announcement CSMS #66427144, clarifying the launch of a fee-collection mechanism for Chinese vessels.

The announcement specifies that relevant fees must be paid via the U.S. Department of the Treasury¡¯s official platform (Pay.gov) within three working days before the vessel arrives at its first U.S. port. Vessels that fail to pay on time or submit valid certificates may face consequences such as refusal of loading/unloading, delayed release, or suspension of customs clearance.

In response to the U.S. measures, China has launched multi-level responses from the government to the industry. Premier Li Qiang recently signed a State Council decree to revise the Regulations of the People¡¯s Republic of China on International Maritime Transportation, adding countermeasure provisions. The China Shipowners¡¯ Association issued a statement on September 30, criticizing the U.S. measures for violating the WTO¡¯s non-discrimination principle.

According to calculations by shipping consulting firm Alphaliner, the policy will impose an additional annual cost burden of $3.2 billion on the world¡¯s top 10 liner companies.

Among them, COSCO Shipping Group and its subsidiary OOCL are expected to bear approximately $1.53 billion; ZIM Integrated Shipping Services, Ocean Network Express (ONE), and CMA CGM will face expenses of $510 million, $363 million, and $335 million respectively. In contrast, Maersk and Hapag-Lloyd will only be affected by $17.5 million and $105 million due to their fleet structures.

Facing the upcoming policy, major shipping alliances have adjusted their route layouts: Premier Alliance and Gemini Alliance have announced the suspension of some U.S. route services and reduced the frequency of Chinese-owned vessels calling at U.S. ports through internal fleet deployment.

According to the latest analysis report from the Baltic and International Maritime Council (BIMCO), although the bulk carrier and some tanker markets will be hit the hardest¡ªwith a considerable number of vessels likely to withdraw from U.S. routes as a result¡ªthe overall freight rates for U.S. importers and exporters are not expected to rise universally at this stage, despite capacity adjustments for some vessel types.

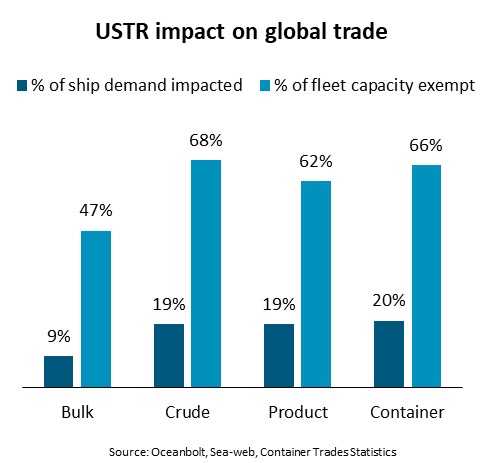

Among the vessels potentially affected by the new regulations, approximately 70% are owned or operated by Chinese entities, and 30% are built in China. However, due to differences in vessel specifications and exemption conditions (such as U.S. shipowner status), more than half of the China-built vessels are expected to be exempt from the fees.

Niels Rasmussen, Chief Shipping Analyst at BIMCO, further analyzed: "Bulk carriers are more significantly affected by rising costs, with 45% of them likely to face USTR fees. For crude oil tankers and container ships, the proportion of affected vessels is approximately 30%, while for product tankers, it is only 19%. This difference mainly stems from the distribution of exempt vessels and the share of Chinese-owned or operated vessels in different vessel types."

Despite the relatively high proportion of affected fleets, the policy¡¯s overall impact on the global shipping market is expected to be limited. Currently, U.S. market demand accounts for only 9% to 19% of the global total demand for various vessel types, and historical data shows that only 16% to 24% of U.S. import and export goods are transported by vessels potentially affected by the new regulations.

In the container shipping sector, BIMCO¡¯s analysis of scheduled liners on East-West routes operated by the top 10 shipping companies shows that less than 20% of the vessels planned to call at U.S. ports will be affected by these fees.

Notably, a number of shipping companies, including COSCO Shipping Lines, OOCL, CMA CGM, MSC, and Maersk, have publicly stated that they will not add additional surcharges to customers for these port fees. Rasmussen said: "Against the backdrop of many liner companies committing not to raise prices, coupled with market competition pressure, COSCO Shipping Lines is also expected to adopt the same strategy. Therefore, freight rates in the container shipping market are expected to remain stable."